By David Snowball

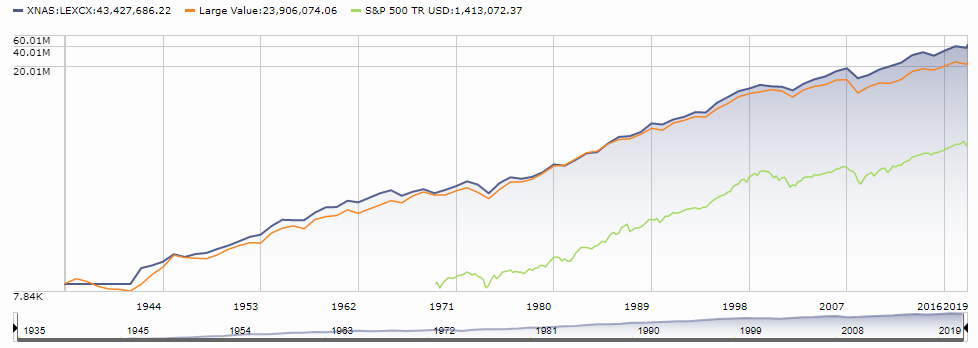

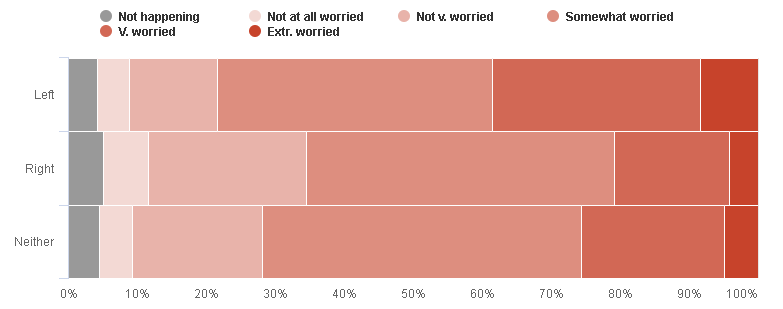

Human actions are causing our planet’s climate to become increasingly unstable. We are beyond the point where that fact is open to debate. Most Americans, Republicans and Democrats both, now accept the reality of climate change. That’s based on fascinating data visualizations provided by the Yale Program on Climate Change Communication. Republicans, far more than Democrats and others, are unsure that there’s a human role or that scientists have reached agreement on what is happening.

The short version is that every serious inquiry reaches the same conclusion: the climate is becoming unstable, human activity is driving the change, the instability is immediate and the effects are potentially catastrophic. For folks who would like to learn more about the subject from a source that’s expert, unbiased, and accessible, NASA’s Global Climate Change is quite informative and easy to follow.

Why NASA? Because NASA and National Oceanic and Atmospheric Administration (NOAA) are the federal government’s lead climate and weather agencies, often working in partnership to gather, test and analyze data. (Thanks, Leah!)

The rising levels of heat-trapping gases in the atmosphere – not just CO2, but also methane, nitrous oxide and others – have both physical and biological effects. There is very good evidence of the physical risks – temperature rise, sea level rise, greater intensity of storms, greater frequency of extreme weather events – and somewhat more question on the biological risks. There’s some evidence, for example, that plants like rice will carry one-third less nutrients and that some plant species (coffee!!!! cacao!) might be pushed toward extinction, but that stuff strikes me as muddier than the physical effects.

At this point, we’ll offer two different paths. The section which immediately follows, The Climate Consensus, is a quick guide to some of the latest reports on climate destabilization, for those interested in learning a bit more. Folks with no such interest might skip to the following section, Climate Conscious Investing Options.

The Climate Consensus

By “consensus,” we mean “a general agreement” and, in particular, “a general agreement among those whose qualifications have earned them the right to a professional judgment.” Yes, I know that sounds vague. At base, there have been seven studies of the beliefs of scientists who actively research the world’s climate; depending on the particular study, you find between 91-100% of climate scientists in agreement. Against that, there are several online petitions you can sign where you simply type your name and your academic background and hit “submit.” The largest such petition claims 31,000 signees, of whom 39 (0.01%) claim to be climate scientists. It appears as if some of the signatures might date to the late 1990s, when the evidence available was much more limited, and it appears that a number of the signatories are … well, long dead. (I searched 10 random names from among the PhDs whose last names started with “A.” Two were dead, in 2007 and 2009, respectively; two exist nowhere on the internet except on this survey; and six were non-climate folks with specialties from pulmonology to mathematics.)

The breadth of the consensus is illustrated by important, authoritative reports released in the last few months.

Lawrence Livermore National Laboratory (2019): less than one chance in a million

Researchers from the Lawrence Livermore National Laboratory have concluded that there’s less than one chance in a million that the changes we’re seeing are natural. Technically, the “five sigma” level of statistical significance. The lead author says, “The narrative out there that scientists don’t know the cause of climate change is wrong. We do.”

U.S. Department of Defense (2019): almost all military installations threatened

The U.S. Department of Defense issued their Report on the Effects of a Changing Climate (2019) which tracks “the significant vulnerabilities from climate-related events in order to identify high risks to mission effectiveness on installations and to operations.” This report focused only on the vulnerability of individual military bases to climate-related threats such as fires and floods, but it follows in a long-line of DOD studies which highlight the broad national security implications of rising sea levels and changing weather patterns. One of the earlier reports was National Security Implications of Climate-Related Risks and a Changing Climate (2015). It begins, “DoD recognizes the reality of climate change and the significant risk it poses to U.S. interests globally.”

U.S. Director of National Intelligence (2019): hazards are intensifying

The Worldwide Threat Assessment of the US Intelligence Community (2019), released by the Director of National Intelligence, identified climate change as a “global threat.”

Global environmental and ecological degradation, as well as climate change, are likely to fuel competition for resources, economic distress, and social discontent through 2019 and beyond. Climate hazards such as extreme weather, higher temperatures, droughts, floods, wildfires, storms, sea level rise, soil degradation, and acidifying oceans are intensifying, threatening infrastructure, health, and water and food security.

U.S. National Climate Assessment (2017, 2018): no convincing alternative explanation

The federal government’s National Climate Assessment includes separate reports on the science of climate change (2017) and the effects of climate change (2018). The science report is pretty definitive:

This assessment concludes, based on extensive evidence, that it is extremely likely that human activities, especially emissions of greenhouse gases, are the dominant cause of the observed warming since the mid-20th century. For the warming over the last century, there is no convincing alternative explanation supported by the extent of the observational evidence.

In addition to warming, many other aspects of global climate are changing, primarily in response to human activities. Thousands of studies conducted by researchers around the world have documented changes in surface, atmospheric, and oceanic temperatures; melting glaciers; diminishing snow cover; shrinking sea ice; rising sea levels; ocean acidification; and increasing atmospheric water vapor.

Intergovernmental Panel on Climate Change (2018): as much as possible, as fast as possible

The most broad-ranging assessments come from the Intergovernmental Panel on Climate Change (IPCC), a UN agency whose “scientists volunteer their time to assess the thousands of scientific papers published each year to provide a comprehensive summary of what is known about the drivers of climate change, its impacts and future risks, and how adaptation and mitigation can reduce those risks.” After a review of over 6000 published scientific reports on climate, the IPCC concluded in October 2018 that “we need to cut carbon pollution as much as possible, as fast as possible.” The Guardian’s ongoing climate change coverage occurs in a feature called Climate Consensus – the 97%, which refers to the finding that 97% of all peer-reviewed climate papers and publications point toward a human role in climate change.

On the impulse to obscure the information

To date, the executive branch’s response to report after report produced by folks charged with protecting our national security has not be exemplary. The Department of Defense report, quoted above, has been removed from the DoD website which is a typical response; the Columbia University Center for Climate Change Law has documented 194 (and climbing) cases of the political wing of the executive branch censoring its own scientists’ or suspending their work, with a fair amount of that work being misquoted by members of Congress. The interface is a tiny bit clunky, you’ll have to select “agency” then scroll down to the letter “D” where you’ll see actions involving the Department of Defense, Department of the Interior and so on. The administration’s most-recent initiative is to create a Presidential Committee on Climate Security led by a guy who (a) is not a climate scientist but nonetheless (b) has dismissed the thousands of climate researchers as “a cult movement” and who (c) endorses what’s sometimes called “the greening of Planet Earth,” a vision of a sort of New Eden propounded by the National Coal Association in the 1992 video of the same name.

Fossil fuels will either run out, destroy the planet, or both. The only possible way to avoid this outcome is rapid and complete decarbonization of our economy. Needless to say, this is an extremely difficult thing to pull off. It needs the best of our talents and innovation, which almost miraculously, it may be getting. It also needs much better than normal long-term planning and leadership, which it most decidedly is not getting yet. Homo sapiens can easily handle this problem, in practice; it will be a closely run race, the race of our lives.

Fossil fuels will either run out, destroy the planet, or both. The only possible way to avoid this outcome is rapid and complete decarbonization of our economy. Needless to say, this is an extremely difficult thing to pull off. It needs the best of our talents and innovation, which almost miraculously, it may be getting. It also needs much better than normal long-term planning and leadership, which it most decidedly is not getting yet. Homo sapiens can easily handle this problem, in practice; it will be a closely run race, the race of our lives.

Jeremy Grantham, investor and founder of Grantham, Mayo, van Otterloo (GMO), “The Race of Our Lives,” keynote address at the Morningstar Investment Conference (2018)

Climate Conscious Investing Options

Our individual actions, whether it’s buying LED bulbs or not buying fossil fuel stocks, will neither save nor doom the planet. Too much of our energy consumption is determined by factors beyond our control: if it’s a two-hour commute to work (welcome to Chicago!) and there’s no plausible alternative to driving, then we drive and our choice of a Corolla versus a Sequoia makes a marginal difference to the planet. At base, collective action, that is, public policy, determines whether the $30 trillion in needed infrastructure gets built or not.

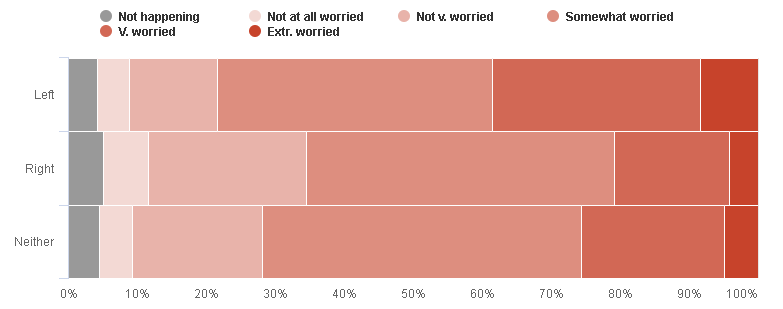

Worldwide, though, recognition of climate destabilization is not a partisan issue. With relatively minor differences, conservatives and liberals elsewhere both look at the evidence, gulp and nod. Below are those results from a survey of citizens in 18 developed nations outside the US.

Folks on the left and right often disagree on how to address the problem, but they tend to agree that there is a real problem. As a result, there’s broad support (outside the US) for vigorous regulatory action.

One popular proposal is setting a price on, and charge for, carbon emissions. Homeowners pay now to have their waste, whether trash or sewage, disposed of. The city’s charge reflects of cost of neutralizing with a pollutant in which raw sewage full of pathogens leaves homes and businesses, it’s collected through several processes, resulting in water that can be safely discharged and, here in Iowa anyway, in bio-solids that can be turned into finished compost that’s sold at a profit. At base, it’s possible to treat waste released into the air in about the same way we treat solid waste or sewage.

The popularity of those ideas is important, because they introduce regulatory risk into the mix of factors for investors to consider. If BP is suddenly paying (pick a number) $50 billion a year for the carbon pollution their product creates, the value of their stock might require dramatic adjustment.

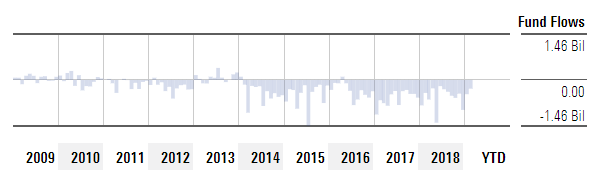

Finally, the popularity of ESG-screened investments is soaring. Morningstar recently reported that the number of ESG funds and ETFs rose 50% (from 235 to 351) in just one year while flows are 30 times greater than they were just a few years ago. Jon Hale, their director of sustainable investing, reports that

…the average inflow per year for [ESG] funds was about $135 million [each year from 2009-2012] –very, very small, tiny. Now, for the past six years the average flow has been about $4.5 billion and $5.5 billion just in the last year.

This reflects the fact that investors, institutional and retail alike, are expressing steadily rising levels of concern about investing in unsustainable or seemingly irresponsible businesses. As Millennials enter their peak earning (and investing) years, the movement of capital away from “irresponsible” businesses and toward “responsible” ones, will increasingly burden corporations. That’s sometimes referred to as reputational risk.

To recap: four sorts of risks, physical, biological, regulatory and reputational. While the big picture narratives about the state of the planet in 2050 or 2100 seem reassuringly distant and abstract, these risks can impact your portfolio in the short term. That’s evidenced by the recent bankruptcy of Pacific Gas & Electric (PG&E) triggered by two years of raging wildfires in California; PCG stock made up 3% of the portfolios of bunches of mutual funds.

Your options as an investor: (1) divest yourself of the stocks most exposed to carbon and related risks; (2) invest in stocks – and, though this is harder, bonds – of firms that might benefit from new regulatory regimes and public demands, (3) invest in stocks of resilient firms; those that are adept at adapting and re-allocating capital and (4) speaking up.

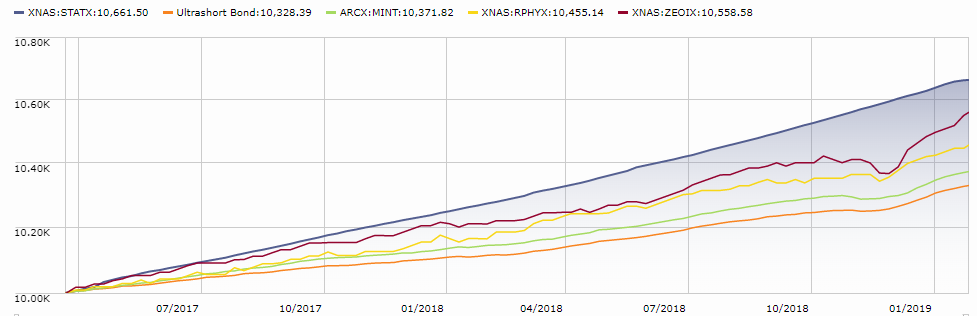

Divest: the good news is that indexes which exclude carbon polluters slightly outperform indexes with include them. For example, the S&P 500 has about the same returns whether energy companies are included or excluded, so a low-carbon strategy costs little. The bad news is that some of the firms central to fossil fuel extraction and refinement are also central to renewable energy development and battery tech.

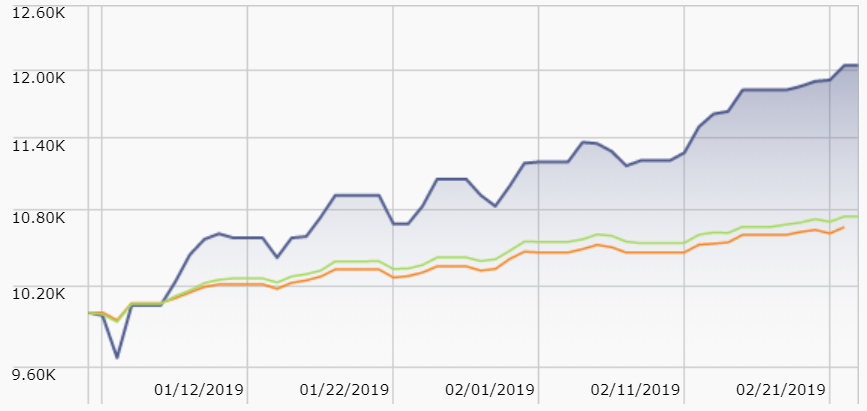

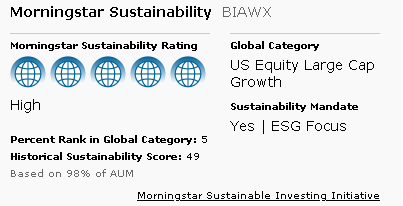

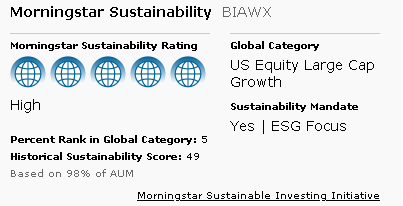

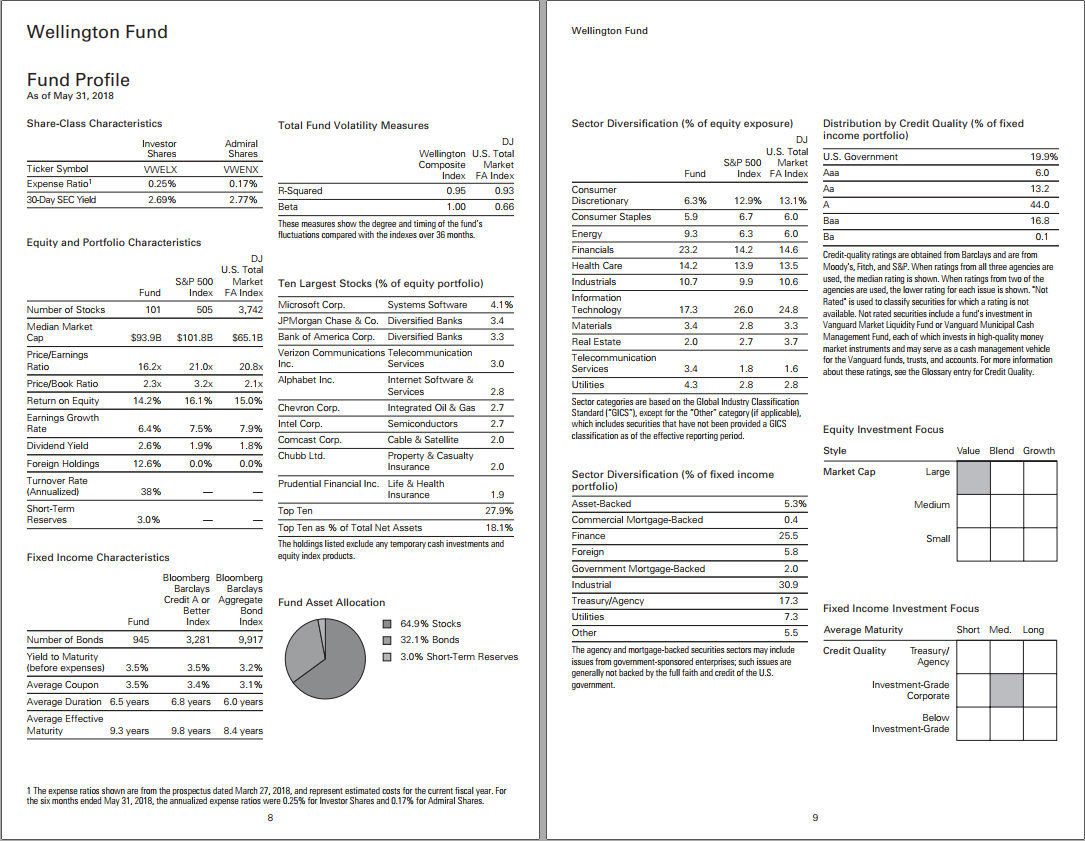

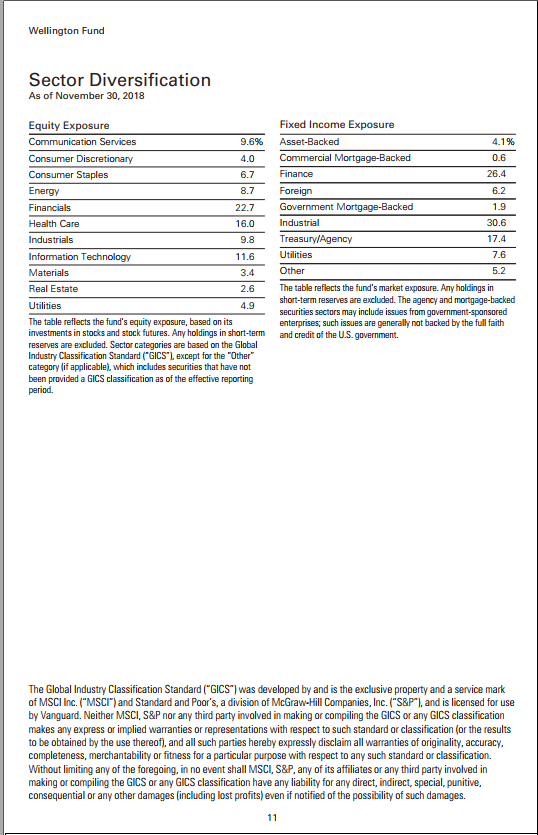

The website fossilfreefunds.org tracks the carbon footprints of hundreds of funds by analyzing the exposures in their portfolios. They list a number of funds, often growth-oriented, with zero exposure to the extraction, processing or combustion of fossil fuels. Attractive options include Brown Advisory Sustainable Growth Fund (BIAWX) and Green Century Balanced (GCBLX). Brown is an MFO Great Owl fund, meaning that it has posted risk-adjusted returns in the top 20% of its peer group for every tracked period greater than one year. My colleague Dennis Baran recently profiled BIAWX.

Green Century got a new management team 11 years ago, and that team has modestly but consistently outperformed its peers.

| |

Annual returns |

Max drawdown |

Standard dev. |

Downside dev. |

Ulcer Index |

Bear market dev. |

Bear rating |

Sharpe ratio |

| Green Century Balanced |

5.1% |

-34.2 |

10.6 |

7.5 |

9.3 |

7.0 |

2 |

0.43 |

| Lipper peer group |

4.7 |

-40.7 |

12.0 |

8.6 |

11.5 |

8.1 |

5 |

0.36 |

Green cells highlight places where the fund has outperformed its peer group over the 11+ years of the current market cycle.

ETF investors have choices like SPDR MSCI ACWI Low Carbon Target ETF (LOWC) and SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX).

Invest: there is compelling evidence at a broad ESG-screened fund can form the core of a long-term portfolio, with no loss of returns or escalation of risk. As a broad generalization, any of the Parnassus Funds. Parnassus Core (PRBLX) and Parnassus Mid-Cap (PARMX) both earned Great Owl designations, while Parnassus Endeavor (PARWX) has somewhat above-average volatility but vastly above-average returns for pretty much every meaningful trailing period. Fans of smart-beta ESG investing might look to the work of Northern Trust Asset Management who, we noted in writing about Northern US Quality ESG (NUESX), “has made a major commitment to responsible investing.” That includes active funds, indexes and smart beta ETFs.

Finally, with most future growth in greenhouse gas emissions coming from Asia, it makes a lot of sense to consider investing in innovators in that half of the world. The cleanest option is Matthews Asia ESG (MASGX), which has substantially outperformed its Pacific stock peers since inception and which benefits from Matthews’ unparalleled depth in the Asia arena. More broadly, a handful of exceedingly solid EM equity funds – Morningstar medalists – also receive Morningstar’s highest sustainability rating: Harding Loevner Emerging Markets (HLEMX), Seafarer Overseas Growth & Income (SFGIX) and Virtus Vontobel Emerging Markets Opportunities (HEMZX, still highly regarded despite the loss of star manager Rajiv Jain two years ago).

Innovate: some managers look for funds that are, in a way, resilient. They have a structural and cultural commitment to innovation. Two outstanding funds with such a focus are Guinness Atkinson Global Innovators (IWIRX) and Seven Canyons World Innovators (WAGTX, formerly Wasatch World Innovators).

| |

Annual returns |

Max drawdown |

Standard dev. |

Downside dev. |

Ulcer Index |

Bear market dev. |

Bear rating |

Sharpe ratio |

| Guinness Atkinson Global |

6.9 |

-56.1 |

18.8 |

12.8 |

17.5 |

12.2 |

8 |

.034 |

| Seven Canyons World |

6.4 |

-59.2 |

17/9 |

13.0 |

18.7 |

12.5 |

4 |

.033 |

Green cells indicate places where the funds have outperformed their respective peer groups over the 11+ years of the current market cycle.

The two funds have earned four- and five-star ratings, respectively, from Morningstar. Both are flexible, global funds run by small, stable management teams. Both have outperformed their peers over the 11+ years of the current market cycle. Guinness Atkinson has a purely large cap portfolio while Seven Canyons invests the vast majority of its portfolio in micro- to mid-cap stocks.

Speak up: in my day job, I’m a communication studies professor. My doctorate is in rhetorical theory and practice. For a quarter century I was a debater, then a debate coach. You had to see this coming, right?

If you invest directly in equities, contact the management of corporations in which you invest and express your views to them. You can find out how your managers think about, and respond to, the environmental risks around their activities by reading their annual Form 10-K, which is available from both the corporation and the SEC. The 10-K will list all of the risks that the corporation faces and how it’s responding to them. By way of illustration, General Motors (2018) writes:

To mitigate the effects of our worldwide operations on the environment, we are converting as many of our worldwide operations as possible to landfill-free operations which reduces greenhouse gas emissions associated with waste disposal. … approximately 50% of our manufacturing operations were landfill-free.

We continue to search for ways to increase our use of renewable energy and improve our energy efficiency … We have committed to meeting the electricity needs of our operations worldwide with renewable energy by 2050 … We continue to seek opportunities for a diversified renewable energy portfolio including wind, solar, and landfill gas.

And so on, in some detail. Like what you read? Congratulate them. Don’t like it? Chastise them.

If you invest indirectly through funds or ETFs, contact the adviser of the fund. Really. I do this all the time. They’re people. They answer the phone. Morningstar publishes a sustainability grade for every domestic equity fund and FossilFreeFunds.org does a similar five-star sort of rating.

and

Check your holdings’ rating. Like what you see? Congratulate the advisors. Don’t like it? Chastise them.

If you live in a democracy, contact the people you elected to represent you. The League of Conservation Voters publishes an environmental voting record for every member of the US Congress. Check out your representative. If you like what you see … well, you know the rest.

Bottom Line: Individual responsibility can’t save the planet. And yet, it’s still the right thing to do. My home is over-insulated and all of the lights are LEDs. My car gets 40 MPG highway, and still I walk rather than drive whenever I can. I eat no red meat and only sustainably-harvested seafood. None of which will save the planet, and yet all of which saves me. Collectively, such actions are good for my health, physical, mental and spiritual. And, for all of us, should be quite enough reason to do them.

The break gives me occasion to read, some of which (a friend’s novel) was deeply engaging and some of which (virtually every online “news” story) was deeply disturbing. Not that the news was disturbing so much as the lunacy of the folks they allow near keyboards. It appeared at times as if the financial analyses were being offered up by the folks from Monty Python’s Flying Circus.

The break gives me occasion to read, some of which (a friend’s novel) was deeply engaging and some of which (virtually every online “news” story) was deeply disturbing. Not that the news was disturbing so much as the lunacy of the folks they allow near keyboards. It appeared at times as if the financial analyses were being offered up by the folks from Monty Python’s Flying Circus.

Fossil fuels will either run out, destroy the planet, or both. The only possible way to avoid this outcome is rapid and complete decarbonization of our economy. Needless to say, this is an extremely difficult thing to pull off. It needs the best of our talents and innovation, which almost miraculously, it may be getting. It also needs much better than normal long-term planning and leadership, which it most decidedly is not getting yet. Homo sapiens can easily handle this problem, in practice; it will be a closely run race, the race of our lives.

Fossil fuels will either run out, destroy the planet, or both. The only possible way to avoid this outcome is rapid and complete decarbonization of our economy. Needless to say, this is an extremely difficult thing to pull off. It needs the best of our talents and innovation, which almost miraculously, it may be getting. It also needs much better than normal long-term planning and leadership, which it most decidedly is not getting yet. Homo sapiens can easily handle this problem, in practice; it will be a closely run race, the race of our lives.

The reality is somewhat more complex than that. The argument in favor of investing in consumer branded food companies has been that the brands had a cachet. They often related to the childhood memories of the consumer, which allowed for pricing power over alternatives in the marketplace such as private label. And under that umbrella, from a capital allocation view point such companies would be able to dedicate a large part of the cash flows to REINVESTMENT in the brands, providing for a constantly growing annuity from those investments.

The reality is somewhat more complex than that. The argument in favor of investing in consumer branded food companies has been that the brands had a cachet. They often related to the childhood memories of the consumer, which allowed for pricing power over alternatives in the marketplace such as private label. And under that umbrella, from a capital allocation view point such companies would be able to dedicate a large part of the cash flows to REINVESTMENT in the brands, providing for a constantly growing annuity from those investments. Now, we do not need to have a tag day for either Mr. Buffett or the people at 3G. They have profited handsomely over time. This should be a wake-up call to them to rethink where appropriate their allocation of capital. But one does wonder about the extent to which these pricing pressures will spread to other areas.

Now, we do not need to have a tag day for either Mr. Buffett or the people at 3G. They have profited handsomely over time. This should be a wake-up call to them to rethink where appropriate their allocation of capital. But one does wonder about the extent to which these pricing pressures will spread to other areas.